As we enter the peak season, We want to highlight the port congestion crisis in the simplest way possible, with some screenshots showing the number of vessels anchored out various ports.

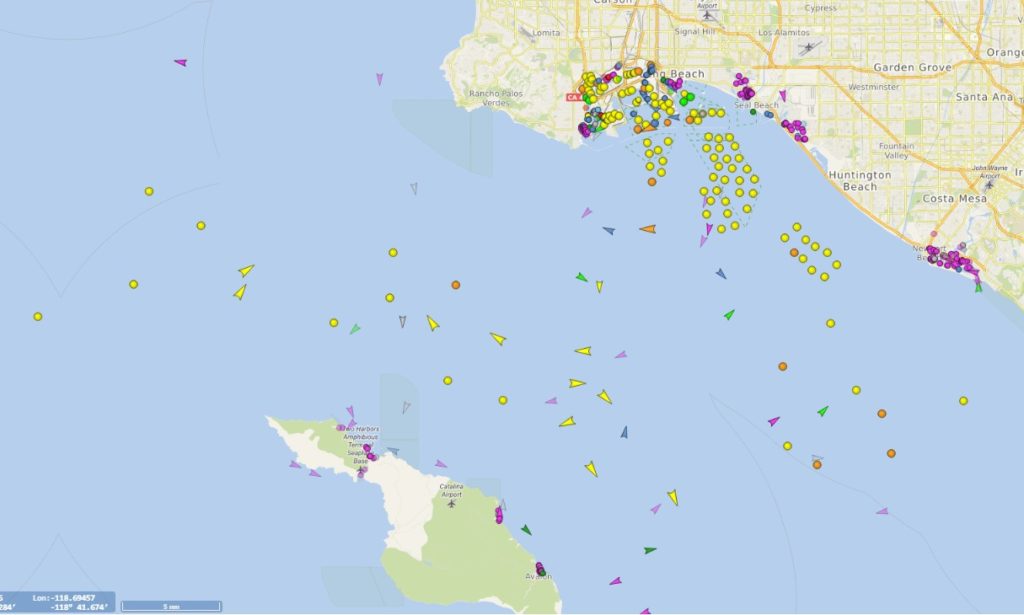

Los Angeles/Long Beach

Around late spring, the number of vessels anchored outside the ports of LA/LB peaked at around 30 vessels. This number briefly dipped into the teens around June/July. Since then, it has surged. As per reports from the American Shipper, there was an all-time high of 61 container ships waiting to be discharged on Wednesday, September 15, 2021. There were so many ships waiting, that the port ran out of space for vessels to anchor. Over 20 vessels were forced to drift further out at sea.

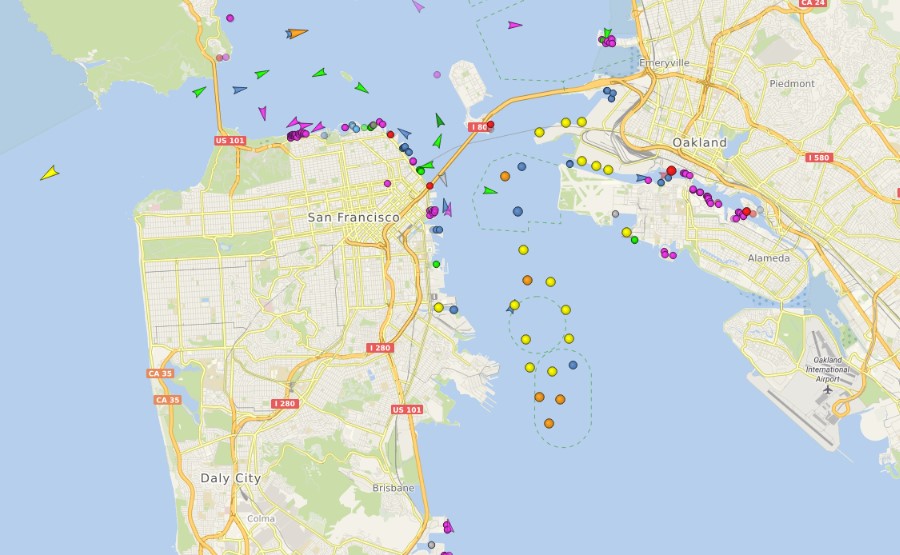

Oakland

The port of Oakland still has about eight vessels anchored on an average day outside the port. The wait time has been reduced to less than a week now. Some of this is due to the congestion in Los Angeles/Long Beach and some of it is due to carriers simply continuing to remove Oakland as a port call.

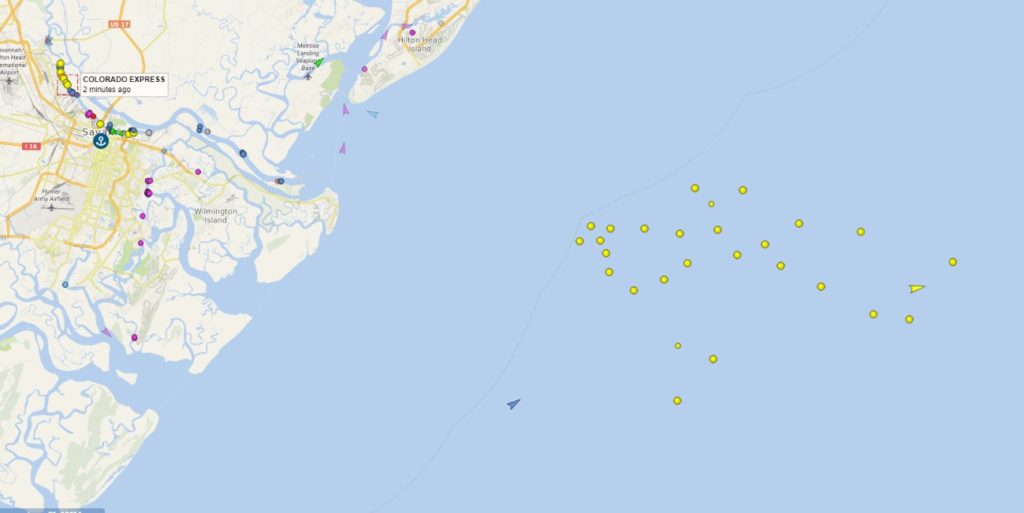

Savannah

East coast ports, Savannah, in particular, has unfortunately also gotten in on the party with over a dozen vessels anchored outside the port.

What is the impact of all this congestion?

1.) Vessel wait times at the destination port are increasing.

LA/LB is reporting vessel wait times at roughly 14 days

Oakland is reporting vessel wait times around 4 days

Seattle is reporting vessel wait times at roughly 12 days

Savannah is reporting vessel wait times at roughly 6+ days

Vancouver is reporting vessel wait times around 8 days.

2.) Congestion at destination terminals

Once containers are discharged from vessels, we’re seeing many containers placed in closed areas. The length of time the containers stay in closed areas can be many days, even beyond the standard free time that the port provides. For dryers, it is very challenging to keep track of when containers become available in closed areas. There are many instances of containers becoming free for pickup appointments, only to have the area closed again within hours of opening up. It is almost an impossible task to keep track of when containers actually become available for pickup.

We also wanted to add that there is now also extreme congestion at CFS warehouses handling LCL cargo. Warehouse are so busy they are often waiting until the last free day to pick up containers. Once the container is picked up, they are taking longer to unload the container and segregate the goods for pickup.

3.) Congestion at rail terminals.

The wait time for containers getting onto rail can last weeks. We have numerous containers bound for Chicago and other inland rail destinations that have waited over a month at LA/LB. This congestion is only going to increase. As the congestion increases, carriers are going to be even more reluctant to book containers to these inland destinations.

4.) Trucking – Drayage and Equipment shortage

We continue to see a lack of drivers available to pick up containers at various ports. Many ports routinely run out of chassis available to move containers. Importers have to be prepared to pay demurrage and waiting time in these instances. We definitely urge importers to be grateful for the drivers who are out there braving the long wait times at the terminals while waiting to get a chassis and then pick up a container for delivery. They are some of the unseen and unheard of heroes in this time doing grueling and often unappreciated work.

5.) Vessel sailing delays in Asia

With more and more vessels stuck waiting at U.S. ports, we’re going to see vessel sailing schedules disrupted throughout Asia. We’re going to see most scheduled sailing dates delayed days, if not weeks. We may even see blank sailings as carriers don’t have vessels available that week to pick up containers.

In an environment where it is already near impossible to find space to ship a container, the vessel delays are only going to heighten this challenge.

6.) Container shortage at ports of origin

With even more vessels stuck at sea, we’re likely to see more container shortages in Asia.

7.) Increasing freight cost

Ocean freight rates continue to climb. We are seeing more and more importers choosing not to import as they cannot afford the insanely high ocean freight costs. Nevertheless, demand for space continues to rise. Ocean freight rates, therefore, continue to climb.

The peak season is upon us now. The transit time for shipments from Asia to the United States is now completely unpredictable. We ask that the importing community to be understanding that shipment delays are bound to continue to occur. These delays and increased costs are out of our control. We are working hard to minimize delays and cost increases.

If you have questions or looking for guidance on how to process your shipping orders should contact Platform88. Stay tuned to Platform88 for the latest on the newsletters.